Charting New Horizons: Formation of Offshore Companies

Wiki Article

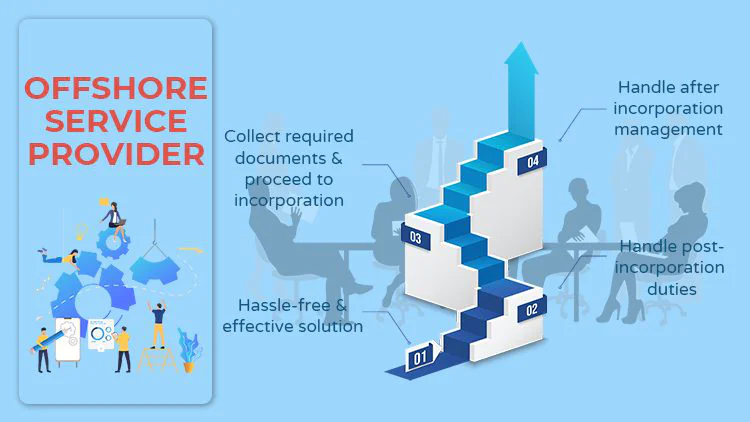

Specialist Offshore Company Monitoring

With globalization and the raising importance of international organization, even more firms are exploring the advantages of developing and managing offshore entities. In this discussion, we will check out the benefits of offshore firm management, key considerations for overseas procedures, and reliable strategies to make sure conformity and lessen risks.

Benefits of Offshore Firm Management

There are several significant advantages to offshore company management that can considerably benefit organizations looking for worldwide growth and monetary optimization. Offshore jurisdictions typically offer favorable tax obligation regimens, consisting of reduced or zero business taxes, minimized resources gains taxes, and exceptions from particular tax obligations on returns and rate of interest.Another advantage is enhanced privacy and asset protection. Offshore business administration permits companies to preserve a higher level of privacy and discretion in their economic events. Offshore territories generally have stringent regulations and policies in position to shield the identity of business owners and shareholders, making it challenging for 3rd parties to gain access to sensitive info. This level of privacy can be especially helpful for services operating in sectors where privacy is critical, such as money, consulting, or innovation.

Additionally, offshore business monitoring supplies services the chance to access a worldwide market. By developing an offshore presence, business can expand their reach and tap right into new markets without the need for substantial physical infrastructure or establishment expenses. This versatility permits services to rapidly adapt to transforming market problems and benefit from brand-new development opportunities.

Secret Considerations for Offshore Workflow

One crucial facet to consider when involving in overseas business monitoring is the careful consideration of essential variables for successful offshore procedures. Offshore operations call for a competent workforce that can effectively take care of the everyday procedures and add to the development of the organization. By carefully taking into consideration these essential elements, business can optimize their offshore operations and achieve lasting success.Ensuring Conformity With Neighborhood Rules

To make sure conformity with regional guidelines, firms taking part in offshore operations need to completely comprehend and stick to the certain lawful needs and governing structure of the offshore territory. Offshore jurisdictions generally have their very own set of laws and regulations that govern numerous elements of service procedures, including firm development, tax, employment, and financial coverage. It is critical for firms to acquaint themselves with these guidelines to avoid possible lawful concerns and charges.One of the very first steps in making certain conformity is carrying out extensive research on the lawful and governing landscape of the picked offshore jurisdiction - formation of offshore companies. This entails studying the local regulations, comprehending the needs for business registration and licensing, and recognizing any type of specific laws that might apply to the business's industry or service tasks

Once the legal requirements are recognized, business need to take positive steps to follow them. This includes obtaining the essential licenses, licenses, and authorizations before commencing procedures, and ensuring ongoing compliance with tax and reporting commitments. It is additionally important to remain upgraded with any kind of amendments or adjustments to the guidelines in order to stay certified.

To promote compliance, firms may think about involving the services of local lawful and accountancy professionals that are skilled in the offshore jurisdiction's regulations. These professionals can provide advice and assistance in browsing the complicated legal landscape, aiding companies to stay clear of compliance pitfalls and make certain smooth operations.

Tax Obligation Planning Approaches for Offshore Companies

Reliable tax obligation preparation is important for overseas organizations to enhance their tax obligation obligations and optimize their financial efficiency. Offshore services typically have the advantage of going through favorable tax regimes, which can dramatically reduce their tax concern. To totally benefit from these advantages, it is critical to develop reliable tax planning approaches.One common tax planning technique for overseas businesses is using tax treaties. These treaties are agreements in between countries that aim to stop double taxation and offer tax address obligation relief for companies operating in multiple jurisdictions (formation of offshore companies). By making use of these treaties, offshore companies can minimize their tax obligation obligations and make certain that they are not paying tax obligations on the same earnings in several countries

Another method is establishing a tax-efficient business structure. This involves establishing a holding company in a tax-friendly territory and structuring business procedures in a means that lessens tax obligation responsibilities. By very carefully preparing the ownership and control of the overseas firm, it is possible to reduce tax obligations on earnings, returns, and funding gains.

In addition, overseas companies can engage in transfer prices techniques to maximize their tax obligation setting. Transfer prices involves identifying the prices at which items, services, and intellectual building are moved between relevant entities within the exact same multinational group. By establishing transfer prices at an optimal level, overseas businesses can assign revenues to low-tax territories, minimizing their total tax obligation liability.

Lessening Dangers in Offshore Operations

Offshore services must prioritize reducing threats in their operations to make sure long-lasting success and economic stability. Operating in an overseas jurisdiction offers one-of-a-kind obstacles and uncertainties that need careful monitoring. To efficiently decrease dangers, overseas services should embrace an aggressive strategy by applying robust risk monitoring methods.One secret facet of risk minimization is conducting detailed due persistance before participating in any type of offshore transactions or partnerships. This involves looking into and verifying the track record, economic stability, and legal conformity of potential service companions or provider. By thoroughly vetting these entities, offshore companies can lower the risk of fraudulent activities or organization with immoral procedures.

Furthermore, offshore services need to apply comprehensive inner control systems to detect and avoid read more any type of prospective deceptive activities within the organization. This consists of developing clear plans and treatments, segregation of duties, regular tracking, and interior audits. By maintaining a robust inner control framework, overseas businesses can reduce the risk of interior fraud and unapproved tasks.

Additionally, offshore companies ought to focus on conformity with worldwide laws and anti-money laundering (AML) actions. Staying up-to-date with developing regulatory needs and applying efficient AML procedures can lessen the threat of legal repercussions and reputational damages.

Finally, offshore organizations must consider obtaining ideal insurance policy coverage to secure versus unforeseen occasions such as natural disasters, political instability, or legal conflicts. Insurance coverage tailored to offshore procedures can provide economic payment and assistance throughout times of dilemma, guaranteeing the connection of company tasks.

Verdict

To conclude, overseas business monitoring supplies different benefits such as tax obligation planning techniques, lessening threats, and making sure conformity with neighborhood regulations. However, it is important for services to carefully consider vital variables for overseas procedures and browse the complexities of different territories. By executing efficient monitoring methods and staying up-to-date with neighborhood laws, services can successfully run offshore and profit of international business opportunities.In this conversation, we will explore the advantages of overseas company monitoring, vital factors to consider for offshore procedures, and effective strategies to make certain compliance and minimize threats.One crucial facet to contemplate when involving in overseas firm management is the cautious factor to consider of crucial factors for effective overseas procedures.To make sure compliance with neighborhood regulations, business involving in offshore procedures must extensively stick and understand to the particular lawful demands and regulatory framework of the overseas jurisdiction. Offshore territories commonly have their own collection of legislations and regulations that regulate different facets of service procedures, consisting of company formation, taxes, employment, and financial reporting. Visit This Link By executing reliable management methods and remaining updated with neighborhood regulations, companies can effectively run offshore and reap the benefits of worldwide organization opportunities.

Report this wiki page